Build Your Own Bank with a Portfolio of Commercial Properties

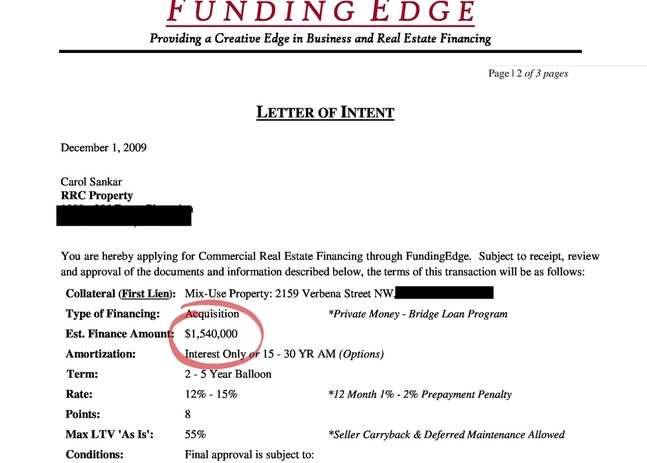

Let me be honest with you, although I am a real estate developer, you DO NOT have to be interested in investing in real estate to purchase assets that will generate consistent cashflow to capitalize your success. The reason many women get rejected for traditional business loans and venture capital is due to a lack of collateral and inaccurate financial projections. I have reviewed several business plans for women owned enterprises, which were severely under funded and cause a red flag for the SBA to guarantee funding. In addition, crowdfunding only works when you have a network. Many people spend their days literally "begging" for contributions on GoFundMe and others without considering the magnitude of the competition. So I decided over a decade ago to create my own funding. I purchase various types of real estate as seed capital to fund my commercial real estate business. By early 2018, I am on target to raise my own capital to start building my own 200 unit apartment complex, without the need for bank financing. However, here is the best part, banks are already knocking on my door constantly to fund the project, and yes, I will have a bank fund it after the project is complete. The debt is a VERY good thing. But you need to learn how to start. This is a LIVE VIRTUAL Training. Here is what we will cover:

|

Stop overthinking & Debating

Best of all, you will have a copy of this training that you can watch over and over. |

|

|

|

May 3-8, 2017

|

- No real estate experience required

-Strictly for women who are committed to generating revenue -Learn how to use real estate to fund your business, create seed capital for expansion and/or generate additional revenue. -With or without any money down (of course the more you invest, the bigger the return) Investment $375 Call in details available after registration 5pm ET | 2pm PT P.S. If you are not ready to take action, this may not be a good fit for you as we will cover layers of content and actual strategies. |